The link is here

Henry George (September 2, 1839 – October 29, 1897) was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the “single tax” on land. He inspired the economic philosophy known asGeorgism, whose main tenet is that people should own what they create, but that everything found in nature, most importantly land, belongs equally to all humanity. His most famous work, Progress and Poverty (1879), is a treatise on inequality, the cyclic nature of industrial economies, and the use of the land value tax as a possible remedy.

[edit]Early life and marriage

George was born in Philadelphia, Pennsylvania, to a lower-middle class family, the second of ten children of Richard S. H. George and Catharine Pratt (Vallance) George. His formal education ended at age 14 and he went to sea as a foremast boy at age 15 in April 1855 on the Hindoo, bound for Melbourne and Calcutta. He returned to Philadelphia after 14 months at sea to become an apprentice typesetter before settling in California. After a failed attempt at gold mining he began work with the newspaper industry during 1865, starting as a printer, continuing as a journalist, and ending as an editor and proprietor. He worked for several papers, including four years (1871–1875) as editor of his own newspaper San Francisco Daily Evening Post.

Birthplace in Philadelphia

In California, George became enamored of Annie Corsina Fox, an eighteen-year-old Australian girl who had been orphaned and was living with an uncle. The uncle, a prosperous, strong-minded man, was opposed to his niece’s impoverished suitor. But the couple, defying him, eloped and married during late 1861, with Henry dressed in a borrowed suit and Annie bringing only a packet of books. The marriage was a happy one and four children were born to them. Fox’s mother was Irish Catholic, and while George remained an Evangelical Protestant, the children were raised Catholic. On November 3, 1862 Annie gave birth to future United States Representative from New York, Henry George, Jr. (1862–1916). Early on, even with the birth of future sculptor, Richard F. George(1865–September 28, 1912),[1][2][3] the family was near starvation, but George’s increasing reputation and involvement in the newspaper industry lifted them from poverty.

George’s other two children were both daughters. The first was Jennie George, (c. 1867 – 1897), later to become Jennie George Atkinson.[4] George’s other daughter was Anna Angela George, (b. 1879), who would become mother of both future dancer and choreographer, Agnes de Mille [5] and future actress Peggy George, (who was born Margaret George de Mille).[6][7]

[edit]Economic and political philosophy

George began as a Lincoln Republican, but then became a Democrat, once losing an election to the California State Assembly. He was a strong critic of railroad and mining interests, corrupt politicians, land speculators, and labor contractors.

One day during 1871 George went for a horseback ride and stopped to rest while overlooking San Francisco Bay. He later wrote of the revelation that he had:

| “ |

I asked a passing teamster, for want of something better to say, what land was worth there. He pointed to some cows grazing so far off that they looked like mice, and said, ‘I don’t know exactly, but there is a man over there who will sell some land for a thousand dollars an acre.’ Like a flash it came over me that there was the reason of advancing poverty with advancing wealth. With the growth of population, land grows in value, and the men who work it must pay more for the privilege.[8] |

” |

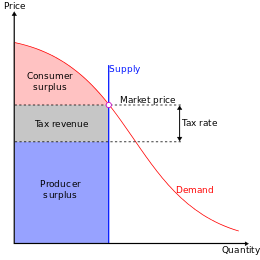

Furthermore, on a visit to New York City, he was struck by the apparent paradox that the poor in that long-established city were much worse off than the poor in less developed California. These observations supplied the theme and title for his 1879 book Progress and Poverty, which was a great success, selling over 3 million copies. In it George made the argument that a sizeable portion of the wealth created by social and technological advances in a free market economy is possessed by land owners and monopolists via economic rents, and that this concentration of unearned wealth is the main cause of poverty. George considered it a great injustice that private profit was being earned from restricting access to natural resources while productive activity was burdened with heavy taxes, and indicated that such a system was equivalent to slavery—a concept somewhat similar to wage slavery.

George was in a position to discover this pattern, having experienced poverty himself, knowing many different societies from his travels, and living in California at a time of rapid growth. In particular he had noticed that the construction of railroads in California was increasing land values and rents as fast or faster than wages were rising.

During 1880, now a popular writer and speaker,[9] George moved to New York City, becoming closely allied with the Irish nationalist community despite being of English ancestry. From there he made several speaking journeys abroad to places such asIreland and Scotland where access to land was (and still is) a major political issue. During 1886 George campaigned for mayor of New York City as the candidate of the United Labor Party, the short-lived political society of the Central Labor Union. He polled second, more than the Republican candidate Theodore Roosevelt. The election was won by Tammany Hall candidate Abram Stevens Hewitt by what many of George’s supporters believed was fraud. In the 1887 New York state elections George came in a distant third in the election for Secretary of State of New York. The United Labor Party was soon weakened by internal divisions: the management was essentially Georgist, but as a party of organised labor it also included some Marxist members who did not want to distinguish between land and capital, many Catholic members who were discouraged by the excommunication of FatherEdward McGlynn, and many who disagreed with George’s free trade policy. Against the advice of his doctors, George campaigned for mayor again during 1897, this time as an Independent Democrat.

Henry George died of a stroke four days before the election.[10] An estimated 100,000 people attended his funeral on Sunday, October 30, 1897 where the Reverend Lyman Abbott delivered an address,[11] “Henry George: A Remembrance”.[12]

[edit]Policy proposals

[edit]Single tax on land

Henry George is best known for his argument that the economic rent of land should be shared by society rather than being owned privately. The clearest statement of this view is found in Progress and Poverty: “We must make land common property.”[13] By taxing land values, society could recapture the value of its common inheritance, and eliminate the need for taxes on productive activity.

Modern-day environmentalists[who?] have agreed with the idea of the earth as the common property of humanity – and some have endorsed the idea of ecological tax reform, including substantial taxes or fees on pollution as a replacement for “command and control” regulation.

[edit]Free trade

George was opposed to tariffs, which were at the time both the major method of protectionist trade policy and an important source of federal revenue (the federal income tax having not yet been introduced). Later in his life, free trade became a major issue in federal politics and his book Protection or Free Trade was read into the Congressional Record by five Democratic congressmen.

[edit]Chinese immigration

Some of George’s earliest articles to gain him fame were on his opinion that Chinese immigration should be restricted.[14] Although he thought that there might be some situations in which immigration restriction would no longer be necessary and admitted his first analysis of the issue of immigration was “crude”, he defended many of these statements for the rest of his life.[15] In particular he argued that immigrants accepting lower wages had the undesirable effect of forcing down wages generally. He acknowledged, however, that wages could only be driven down as low as whatever alternative for self-employment was available.

[edit]Secret ballots

George was one of the earliest, strongest and most prominent advocates for adoption of the Secret Ballot in the U.S.A. [16]

[edit]Hard currency and national debt

George supported government issued notes such as the greenback rather than gold or silver currency or money backed by bank credit.[17]

[edit]Subsequent influence

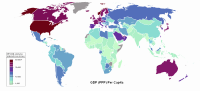

In the United Kingdom during 1909, the Liberal Government of the day attempted to implement his ideas as part of the People’s Budget. This caused a crisis which resulted indirectly in reform of the House of Lords. George’s ideas were also adopted to some degree in Australia, Singapore, South Africa, South Korea, and Taiwan. In these countries, governments still levy some type of land value tax, albeit with exemptions.

Fairhope, Alabama was founded as a colony by a group of his followers as an experiment to try to test his concepts.

Although both advocated worker’s rights, Henry George and Karl Marx were antagonists. Marx saw the Single Tax platform as a step backwards from the transition tocommunism.[18] On his part, Henry George predicted that if Marx’s ideas were tried the likely result would be a dictatorship.[19]

Henry George’s popularity decreased gradually during the 20th century, and he is little known today. However, there are still many Georgist organizations in existence. Many people who still remain famous were influenced by him. For example, George Bernard Shaw [2], Leo Tolstoy’s To The Working People [3] , Sun Yat Sen [4], Herbert Simon [5], and David Lloyd George. A follower of George, Lizzie Magie, created a board game called The Landlord’s Game in 1904 to demonstrate his theories. After further development this game led to the modern board game Monopoly. [6]

J. Frank Colbert, a newspaperman, a member of the Louisiana House of Representatives and later the mayor of Minden, joined the Georgist movement during 1927. During 1932, Colbert addressed the Henry George Congress at Memphis, Tennessee.

Also notable is Silvio Gesell‘s Freiwirtschaft [7], in which Gesell combined Henry George’s ideas about land ownership and rents with his own theory about the money system and interest rates and his successive development of Freigeld.

In his last book, Where do we go from here: Chaos or Community?, Martin Luther King, Jr referenced Henry George in support of a guaranteed minimum income.[8] George’s influence has ranged widely across the political spectrum. Noted progressives such as consumer rights advocate (and U.S. Presidential candidate) Ralph Nader [9] andCongressman Dennis Kucinich [10] have spoken positively about George in campaign platforms and speeches. His ideas have also received praise from conservative journalistsWilliam F. Buckley, Jr. [11] and Frank Chodorov [12], Fred E. Foldvary [13] and Stephen Moore [14]. The libertarian political and social commentator Albert Jay Nock[15] was also an avowed admirer, and wrote extensively on the Georgist economic and social philosophy.

Mason Gaffney, an American economist and a major Georgist critic of neoclassical economics, argued that neoclassical economics was designed and promoted by landowners and their hired economists to divert attention from George’s extremely popular philosophy that since land and resources are provided by nature, and their value is given by society, they – rather than labor or capital – should provide the tax base to fund government and its expenditures.[20]

The Robert Schalkenbach Foundation [16], an incorporated “operating foundation,” also publishes copies of George’s work on economic reform and sponsors academic research into his policy proposals [17].

[edit]Economic contributions

George developed what he saw as a crucial feature of his own theory of economics in a critique of an illustration used by Frédéric Bastiat in order to explain the nature of interestand profit. Bastiat had asked his readers to consider James and William, both carpenters. James has built himself a plane, and has lent it to William for a year. Would James be satisfied with the return of an equally good plane a year later? Surely not! He’d expect a board along with it, as interest. The basic idea of a theory of interest is to understand why. Bastiat said that James had given William over that year “the power, inherent in the instrument, to increase the productivity of his labor,” and wants compensation for that increased productivity.

George did not accept this explanation. He wrote, “I am inclined to think that if all wealth consisted of such things as planes, and all production was such as that of carpenters — that is to say, if wealth consisted but of the inert matter of the universe, and production of working up this inert matter into different shapes, that interest would be but the robbery of industry, and could not long exist.” But some wealth is inherently fruitful, like a pair of breeding cattle, or a vat of grape juice soon to ferment into wine. Planes and other sorts of inert matter (and the most lent item of all—- money itself) earn interest indirectly, by being part of the same “circle of exchange” with fruitful forms of wealth such as those, so that tying up these forms of wealth over time incurs an opportunity cost.

George’s theory had its share of critiques. Austrian school economist Eugen von Böhm-Bawerk, for example, expressed a negative judgment of George’s discussion of the carpenter’s plane. On page 339 of his treatise, Capital and Interest, he wrote:

In the first place, it is impossible to support his distinction of the branches of production into two classes, in one of which the vital forces of nature are supposed to constitute a special element which functions side by side with labour, and in the other of which this is not true. […] The natural sciences have long since proved to us that the cooperation of nature is universal. […] The muscular movements of the person using the plane would be of little use, if they did not have the assistance of the natural forces and properties of the plane iron.

Later, George argued that the role of time in production is pervasive. In “The Science of Political Economy”, he writes:[21]

[I]f I go to a builder and say to him, “In what time and at what price will you build me such and such a house?” he would, after thinking, name a time, and a price based on it. This specification of time would be essential…. This I would soon find if, not quarreling with the price, I ask him largely to lessen the time…. I might get the builder somewhat to lessen the time… ; but only by greatly increasing the price, until finally a point would be reached where he would not consent to build the house in less time no matter at what price. He would say [that the house just could not be built any faster]….

The importance … of this principle that all production of wealth requires time as well as labor we shall see later on; but the principle that time is a necessary element in all production we must take into account from the very first.

According to Oscar B. Johannsen, “Since the very basis of the Austrian concept of value is subjective, it is apparent that George’s understanding of value paralleled theirs. However, he either did not understand or did not appreciate the importance of marginal utility.”[22]

Another spirited response came from British biologist T.H. Huxley in his article “Capital – the Mother of Labour,” published in 1890 in the journal The Nineteenth Century. Huxley used the principles of energy science to undermine George’s theory, arguing that, energetically speaking, labor is unproductive.

George’s early emphasis on the “productive forces of nature” is now dismissed even by otherwise Georgist authors.

[edit]See also

[edit]References

- Notes

- ^ Obituary, New York Times

- ^ http://www.guariscogallery.com/browse_by_artist.html?artist=595

- ^ “SINGLE TAXERS DINE JOHNSON; Medallion Made by Son of Henry George Presented to Cleveland’s Former Mayor”, The New York Times – May 31, 1910

- ^ Obituary – Th New York Times, May 4, 1897

- ^ http://www.imdb.com/name/nm0210350/bio

- ^ http://www.imdb.com/name/nm0313565/bio

- ^ http://asteria.fivecolleges.edu/findaids/sophiasmith/mnsss11_bioghist.html

- ^ Quoted in Nock, Albert Jay. “Henry George: Unorthodox American, Part I“.

- ^ According to his granddaughter Agnes de Mille, Progress and Poverty and its successors made Henry George the third most famous man in the USA, behind only Mark Twain andThomas Edison. [1]

- ^ “Henry George’s Death Abroad. London Papers Publish Long Sketches and Comment on His Career”. New York Times. October 30, 1897. Retrieved 2010-03-07. “The newspapers today are devoting much attention to the death of Henry George, the candidate of the Jeffersonian Democracy for the office of Mayor of Greater New York, publishing long sketches of his career and philosophical and economical theories.”

- ^ http://cooperativeindividualism.org/georgists_unitedstates-aa-al.html

- ^ http://cooperativeindividualism.org/abbott-lyman_on-henry-george.html