Photo: Florida Memory

Photo: Florida Memory

Rockefeller’s Right Hand Man: Henry Flagler

By Michael D. Roberts

History can be fickle. Take the story of the two men who walked Euclid Avenue in the days when its magnificent mansions made it one of the grand boulevards of the world. They were often seen together in deep conversation about their work.

One man, the taller of the two, would go on to become part of American folklore, while the one of brisk step would become an historical afterthought, obscured by the myopia of chroniclers who overlooked his importance in creating the world’s largest business venture.

The taller man was John D. Rockefeller, destined to become the richest man in the world, and the more vigorous at his side was Henry M. Flagler who played no small role in the accumulation of that wealth. They were neighbors walking to their offices where they were business partners, sharing a large partner’s desk.

They lived in a period of Cleveland history that spanned the years between the Civil War and the turn of the 20th Century. It was a period marked by achievement and wealth, one that would never be duplicated here.

The era was the catalyst for the industrialization of America, and made Cleveland the international focus for electricity, steel, oil, paint, communications, chemicals and machine tools. For the most part, history has been generous to the makers of this remarkable time. They were the predecessors of the Fortune 500.

Their names read like a manifest of industry itself: Rockefeller of Standard Oil, Wade of Western Union, Glidden, Sherwin and Williams of paint, Chisholm and Otis of steel, Brush of the electric light, White of sewing machines and trucks, Warner and Swasey of optics and machine tools, and Grasselli of chemicals.

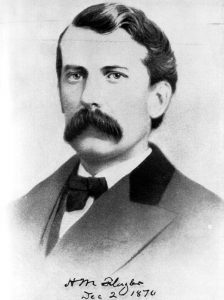

But one notable figure of the era has not been celebrated by local historians to the extent he deserves. Largely because of his retiring demeanor and preference for the more obscure side of business along with anonymity as a hallmark of his charitable efforts, Henry M. Flagler has not been accorded a significant place in the mosaic of Cleveland history. In many city histories he has gone unmentioned.

Even the titan of the times, John D. Rockefeller, once remarked that he wished he had Flagler’s brains. Rockefeller knew better than most this man’s capabilities and some say Flagler had as much to do with making Standard Oil the most powerful company in the world as did Rockefeller himself.

By most accounts, Flagler was a dapper, good humored man whose manner radiated an ease that could be disarming, for in many ways he was a rogue, a man made for the times. Behind this charm was a cunning and toughness that was managed by an extraordinary mind. He kept an amusing, but prophetic sign on his desk that read:

Do unto others as they would do unto you—and do it first.

Flagler was nearly ten years older than Rockefeller having been born in Hopewell, New York, in February of 1830, the son of a traveling Presbyterian minister. At 14, with little formal education, but sharp of wit and a quick study, Flagler set out to make his way in the world, leaving a small town in New York to seek similar surroundings in Northwestern Ohio in a place called Republic near Sandusky.

He was able to get a job clerking for $5 a month plus room and board. It soon became evident that Flagler had a keen eye for the intangibles needed to be successful in the world of commerce. Within the year, his pay was increased to $12 monthly, but more importantly storekeeping was nurturing the flair he was developing for business.

Later, he liked to tell friends how he learned how to apply the concept of value to business deals, by selling brandy from the same barrel to customers based on what they would pay for it and not a standard price.

In 1853, Flagler married the niece of Stephen V. Harkness a prominent citizen of Bellevue who owned several businesses including a distillery. Liquor was a valued commodity and easily made in stills using the abundant grain found in rural areas. While beer was selling for 13 cents a quart, whiskey sold for half as much and it was in the liquor business that Flagler made his first fortune a few years before the Civil War.

With his strong religious upbringing, Flagler abstained from alcohol, but saw no sin in selling as much as he could to others. He had no moral aversion to profit.

Harkness was related through Henry’s step-brother, Dan Harkness, who was older. They had grown up together. Flagler’s affiliation with the Harkness family would have a fortuitous effect upon his future.

It was in the late 1850s that Flagler met John D. Rockefeller who was working for a Cleveland grain broker and traveled the hinterlands in search of business. By the start of the Civil War in 1861, Rockefeller was brokering most of the Harkness grain.

As the grim realities of war approached, Flagler did two things. He bought his way out of military service, paying $300 for a substitute to take his place in the ranks. The other thing he did was to abandon the liquor business for yet another venture, salt.

The enormous army being assembled needed to be fed and salt was a much needed preservative. And there were abundant salt springs just north in Saginaw, Michigan. In 1862, Flagler and another family member started a salt company.

At first, the Flagler salt venture was successful as the demand for it by the war drove prices up followed by the creation of many competing companies. But as the war came to an end, the demand for salt collapsed, resulting in the demise of many businesses including Flagler’s.

With the reduced demand for salt there began an effort on the part of the industry to control the price and flow of the product. Flagler witnessed the formation of a cartel intended to squeeze out competition. In fact, in later years he would become an expert in this “squeeze” and used the word to describe the elimination of competitors.

His experience in the salt business, particularly his failure to anticipate the drop in prices and the formation of anti-competitive coalition, cost him the fortune he made in liquor and proved to be an indelible lesson. He was $50,000 in debt and needed a job.

Failure never prevented him from pursuing what he enjoyed most: making money. After the demise of his salt business, he moved to Cleveland where he joined a merchant commission house, prospered, paid off his debt and bought the business.

The move to Cleveland would prove to offer an even greater fortune, one that destined Flagler to become an integral, if not principal figure, in creating the greatest industrial company the world had known. What sparked this adventure was Flagler’s reunion with his acquaintance from his merchant days in Bellevue, John D. Rockefeller.

With the discovery of oil in Pennsylvania in 1859, there began a frenzy among speculators as to how to best generate wealth from the geysering, black liquid that would change the world. It was only natural that Rockefeller’s attention would be drawn to those oil fields and the fortune that beckoned.

The main use of oil at the time was for lighting. Refined into kerosene, oil changed the way people lived, making the days longer and brighter. The demand for such an illuminator was worldwide.

Finding the oil was one thing, but extracting it from the ground, shipping it and refining it into a product that was safe and inexpensive, presented quite another set of problems. These were the problems that Rockefeller dealt with daily when he and Flagler joined in business in 1867.

Their bond had been cemented by a large investment in the fledgling company on the part of Flagler’s uncle, Stephen V. Harkness. In a short time, the firm of Rockefeller, Andrews and Flagler owned two refineries and a sales office in New York.

Samuel Andrews was a refining expert, having developed several different processes to give oil a distinctive quality at an economical cost. Rockefeller was a man of frugality and detail. He had intricate knowledge as to how many staves were in a barrel or the number of drops of solder that it took to seal a can.

Rockefeller also had an eye for talent, too, and in Flagler he found an alter ego, a man of verve and spirit that fit the reckless, if not lawless, days that characterized the Gilded Age and the robber barons that made it. Simply said, Flagler was the smartest man that Rockefeller had ever met.

This was providential, for the task before them was mercurial, presenting one financial hazard after another with no effective way to control the rapid rise and fall in prices caused by increasing competition and over production of crude oil. Within a few years the price of a barrel could fluctuate from 10 cents to $13.25. It seemed that anyone with a few dollars could open a refinery, even if it was nothing but a shed where a few barrels a day could be distilled.

In the meantime, Flagler was put in charge of the firm’s transportation issues, a key responsibility since the cost of shipping oil could make a large difference in the profit margin. Years later this would be the crux of the government’s case against the company’s efforts to become a monopoly.

Flagler’s basic job was to negotiate the rates with railroads, canal boats and pipelines. He was doing this as Rockefeller was consolidating the thirty-some refineries in Cleveland by adding them through buyouts or force.

As the firm’s capacity to produce refined oil increased, the need for cheaper freight rates became imperative to fend off competitors. The crude oil was shipped from Pennsylvania to Cleveland where it was refined. The finished product was then shipped to New York where it was sold for export.

Flagler was deft and precise in his dealings with the railroads. He guaranteed to ship a substantial amount of oil on a given line in a timely manner in return for a secret rebate. The results of an early negotiation with one line showed that the regular freight fee was $2.40 a barrel and Flagler had engineered a preferential rate of $1.65. He became expert at playing the railroads off against each other, particularly during their frequent rate wars. Secrecy was essential because other oil firms were being charged more to ship on the same line.

By 1870, the firm’s business had burgeoned enormously. Investors and other oil companies were eager to join the ranks of the prospering enterprise. Recognizing the need for more capital, but fearing the loss of control, the partners were faced with a dilemma.

Years later Rockefeller would attribute the solution to the dilemma to Flagler’s brilliance. On January 10, 1870, a company called Standard Oil was created in a brief 200-word incorporation document written by Flagler, who had no legal training, but whose idea created one of the greatest commercial ventures of all time.

At the time of the incorporation Rockefeller owned 2,667 shares. Flagler had 1,333 shares, but he voted the Harkness shares giving him equal status in the leadership of the company. There was never a serious dispute between the men over the company.

Once the new company was in existence it was voracious in its acquisitions of refineries, first dominating the Cleveland market and then reaching out into other regions. By the spring of 1872, Standard Oil was refining 10,000 barrels of oil daily, employing 1,600 workers with a weekly payroll of $20,000. Cleveland was well on its way to becoming the oil capitol of America.

Flagler liked to use the term “sweat” in association with the acquisition of competitors. That meant that there was little room for negotiation. They either had to sell to Standard or simply go out of business. The offer for these “sweated” businesses was consistent. The deal was cash or Standard Oil stock. Ironically, nearly all who took stock prospered far beyond their expectations. Many of those who had taken cash became bitter as they witnessed the rise of Standard Oil.

The immense volume of oil spawned ever more favorable freight rates and became the tool which Rockefeller and Flagler used to acquire more and more competitors. The precise date of Standard Oil’s rise to the domination of the nation’s oil industry was October 17, 1877 when it purchased Empire Transportation Company and the Columbia Conduit Company thus becoming the primary provider of oil traffic to Europe. These companies owned a combination of rail cars, shipping and pipelines. Not only did Standard Oil control the nation’s refining industry, it now was poised to control the transportation of oil.

By 1877, Cleveland could no longer contain the vast reach of Standard Oil’s international business and the company began to shift its headquarters to New York. In the fall of that year, Flagler moved to New York, thus bringing to an end his years in Cleveland.

These had been good years in Cleveland which he had enjoyed socially and as a leading member of the First Presbyterian Church. His wife, Mary, who had been ailing most of her life, was the focus of his personal concerns. At night he would return to his mansion on Euclid Avenue in the evening and read to her. One account said that he only missed two such evenings in 17 years.

As Standard Oil extended its grip on the industry, it began to be challenged by legal issues. The company was authorized to do business only in the state of Ohio. To operate a refining business in another state, on the face of it, was illegal. To skirt the law, Flagler devised a series of trusteeships to operate these businesses acquisitions.

He also conceived several plans that would consolidate the oil industry to give the company an advantage. While the initial plans failed, they drew the attention of competitors and the authorities. In April of 1879, Rockefeller, Flagler and others were indicted in Pennsylvania in connection with an attempt to create a monopoly.

While nothing came of this legal action, it was the beginning of a string of investigations and media inquiries that would extend into the next century and force anti-trust action to break the company into 33 entities.

The legal manipulations and subsequent investigations were chronicled by Ida Louise Tarbell, the foremost muckraker of her day, and author of the famous book The History of the Standard Oil Company.

Flagler’s ties with Standard Oil slowly gave way, although he remained active when it became clear that the only way for the company to keep its dominance over the oil business was to gain favored cooperation of the pipeline companies that were being built in the east.

Negotiating for the control of pipelines was Flagler’s last daily involvement with Standard Oil. He would remain linked to the company as a consultant and stockholder, but his attention and fortune was being ever more drawn to Florida where he had first visited prior to Mary’s death in May of 1881. He married twice more, having had three children by his first wife.

Flagler had always been remote and elusive with the media and his timely exit from the operations of Standard Oil allowed him to be a peripheral figure in the anti-trust scandal that would be shouldered by Rockefeller in the coming decades.

In time, the Flagler name would be more associated with the development of Florida and the construction of its railroads. He invested $50 million in the state. His days in Cleveland, from 1867 to 1877 were overshadowed by the audacity of his efforts in Florida, particularly the construction of a railroad from Daytona over the ocean to Key West.

No one was more responsible for the development of that state than was Henry Flagler. Sensing the potential of tourism, Flagler first built the 54-room Hotel Ponce de Leon in St. Augustine.

He built a bridge over the St. Johns River, opening Southern Florida to rail traffic, and purchased a hotel near Daytona. He then expanded his burgeoning rail system to Palm Beach which became the winter Mecca for American society.

He built his house, the Whitehall in Palm Beach which is now the Flagler Museum. His rambling Breakers Hotel continues as the city’s dominant hostelry.

Unwilling to bask in the sunshine of achievement, Flagler extended the Florida East Coast Railway to Biscayne Bay by 1896. Here he paused to create a city, carving out streets, installing water and electricity, and even funding the town’s first newspaper.

Famed and revered, Flagler remained a modest man and when the townspeople urged that the city be named after its benefactor, he turned it down, insisting that the better name would be that from Indian lore— Miami.

Envisioning trade with Latin American and access to the Panama Canal, he pressed on with his railway to Key West, taking seven-years of hop scotching from key to key on bridges that were engineering marvels. In 1935, a fierce storm destroyed the 107-mile railroad. As a commercial venture, it never succeeded.

In 1902, Rockefeller, now somewhat distant from his old friend and business partner, wrote Flagler the following:

You and I have been associated in business upwards of thirty-five years, and while there have been times when we have not agreed on questions of policy, I do not know that one unkind word has ever passed or unkind thought existed between us. I feel my pecuniary success is due to my association with you, if I have contributed anything to yours I am thankful.

Flagler died on May 20, 1913 in Florida at the age of 83.

The memory of Rockefeller and Flagler walking to work on Euclid Avenue and plotting their world-wide dominance of the oil industry amid the clatter of hoofs and the cry of coachmen is an image that deserves preservation as a unique moment in Cleveland history. Flagler was a personage never to be underestimated, especially by the hindsight of history.